About “Closing” year end in QuickBooks

I am often asked by customers about “closing” their books at year-end. Many old-school and complex accounting programs require you to per form a closing process at the end of a financial year before entering any information for the current year. In fact, at the large corporation I used to work, we had to close the books every month! After the closing process is complete, the information is “locked down” and there is no changing it. Period. This creates deadlines, bottlenecks, and stress for all of us in accounting trying to get our work done.

form a closing process at the end of a financial year before entering any information for the current year. In fact, at the large corporation I used to work, we had to close the books every month! After the closing process is complete, the information is “locked down” and there is no changing it. Period. This creates deadlines, bottlenecks, and stress for all of us in accounting trying to get our work done.

Most small business owners are not native accountants and don’t understand the exact reason for the “closing” procedure, they just know it’s something that is done, and don’t they need to do it? The answer is yes, and no. Large businesses that provide periodic financial statements to shareholders and/or Board Members must ensure that the statements are accurate and will not be changed after presentation. They must close the books in finality at certain periods in order to present this information as complete. For most small businesses, the cut off is related to filing their tax return. In other words, once you run the Profit and Loss and Balance Sheet and use that information to file your taxes, you do not want to make any further changes to that year’s data. That makes sense; after all, if you entered some additional Income or Expenses after the year is over, it wouldn’t be reported on your tax return ever.

QuickBooks doesn’t have a formal “closing” process, and this makes some people feel like it must not be a “real” accounting program. But QuickBooks is designed for Small Business users, and, although it can be dangerous, there are practical reasons why QuickBooks leaves prior year data open for editing. The main reason is that it is just not practical to expect every small business to complete all of their yearend work before creating any other transactions in the New Year. Often there are credit card expenses coming in on statements clear through February. Another reason is that many of us depend on our CPA or tax preparer to provide us with adjustments like depreciation expenses that need to be entered once the tax return is prepared… and that could be much later. So, rather than imposing a locked down closing, QuickBooks creates a Journal Entry automatically at the end of the year to transfer the Net Income to Retained Earnings and allows you to set a closing date password. The closing date password feature allows anyone with the password to change prior year’s data, and helps keep you from accidentally entering anything into the wrong year.

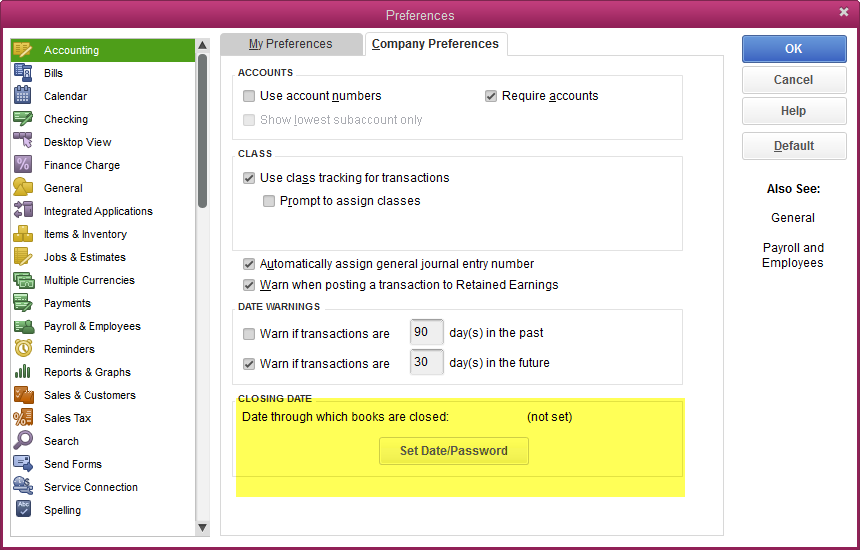

Once I have completed my year end closing tasks I set a closing date password. To access the feature in QuickBooks: From the Edit menu –select Preferences – on the left of this new window – At the top of the Preferences Menu click – Accounting – and then choose the Company Preferences tab on the Right. At the bottom of the Company Preferences window, you will see the Set Date/Password button under the Closing Date section. When you click this button, another window opens and allows you to select a closing date and enter a password. For the closing date, you should enter the last day of the year, not the first date of the New Year. Keep your password simple and easy to remember, I recommend writing it down…. And, of course….. not forgetting where you wrote it down!

Questions? Get one on one training and support from Penny Lane – www.jobcosting.com/coaching , like my facebook page for the latest Tips and Tricks: www.facebook.com/jobcosting and don’t forget to subscribe to my youtube channel: https://www.youtube.com/channel/UCWoPuSBIRitWlgaYfOHplog?sub_confirmation=1

Questions? Get one on one training and support from Penny Lane – www.jobcosting.com/coaching , like my facebook page for the latest Tips and Tricks: www.facebook.com/jobcosting and don’t forget to subscribe to my youtube channel: https://www.youtube.com/channel/UCWoPuSBIRitWlgaYfOHplog?sub_confirmation=1