Have you ever gotten to the end of a big job and suddenly found yourself in a major cash flow crunch? Are you frustrated because when you look at your Profit and Loss report it makes NO SENSE?

There’s a very good reason for this and it’s not your analytical skills: In the contracting business, it’s likely that at any given period of time, the costs you’ve incurred rarely line up with the revenue you’ve invoiced for.

Oftentimes, draw schedules are heavily front-loaded: You are drawing ahead for costs that you will soon incur. This is great until the job nears completion, when you’ve already collected the money, but still have to pay all of the costs to finish the job. During the earlier months of the job, you are often over-billed, and near the end, you are under-billed.

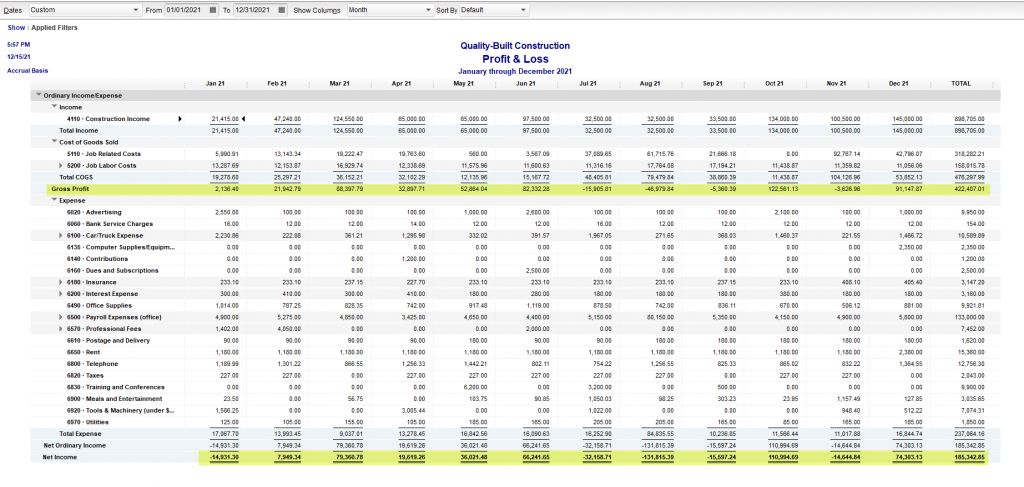

Sometimes, it’s the opposite: The contractor must incur costs and then invoice the customer and get paid. In this case, you are often under-billed. With multiple jobs going at once, this can result in complete chaos on your Profit and Loss report, with gross and net profits fluctuating wildly from month to month and even year to year:

It’s not just you, this report doesn’t make any sense and it’s probably not accurate. How can you LOSE over $14k in November and make a profit of $111k in October? These numbers are all over the place. I look at the financial reports for different contractors every day (it’s fun for me, really). All over the country, all different types and sizes, and this is what they look like 99% of the time.

You know why it happens: Maybe, you invoiced a client $100k in October, but actually incurred most of the costs for that draw in November. For most contractors, this is just the way it is. All the time. There are probably multiple jobs involved and different jobs involved in each period at varying levels of over and under billing.

So, what to do?

The only way I know to get accurate financial statements in this situation is to make regular (monthly) over and under billing adjustments. I won’t lie, it is work and it’s somewhat tricky. In my Job Costing Intensive Program, I’ve got a video on this and a nifty spreadsheet. In this article I’m going to give you exact instructions on how to make this adjustment.

I should mention that this is for Contractors who operate their accounting on a percentage of completion basis: You recognize your revenue AND costs during any period based upon a % of completion of your jobs. This is true for most Contractors who are not building speculative projects.

The key here, is to match the revenue invoiced during a certain period with the costs incurred during that period. To make this adjustment, you must:

- Have a solid job costing system in place

- Know your estimated costs for a job vs. the estimated revenue for that job, and to use QuickBooks reports, you must enter your Estimates with the estimated costs in the Cost column and any mark up in the mark up column of the estimate

- Always run the Profit and Loss on an Accrual basis, even if you are on a cash basis for taxes (see this article: https://jobcosting.com/cash-vs-accrual-based-accounting%E2%80%A6-what-does-it-mean/)

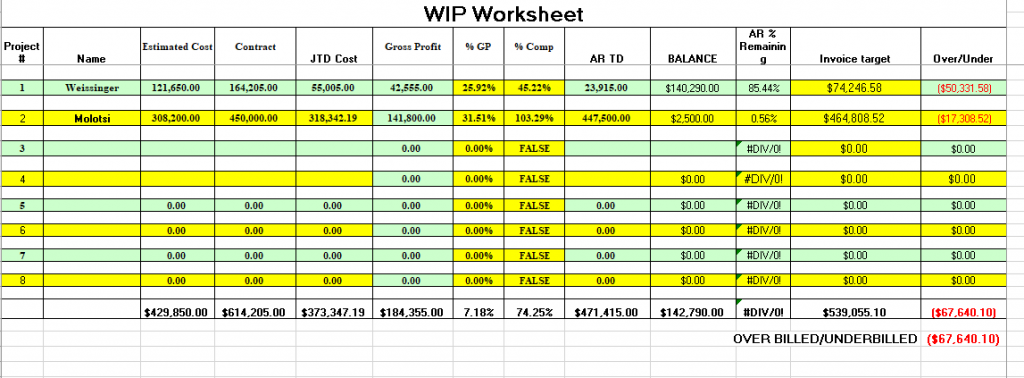

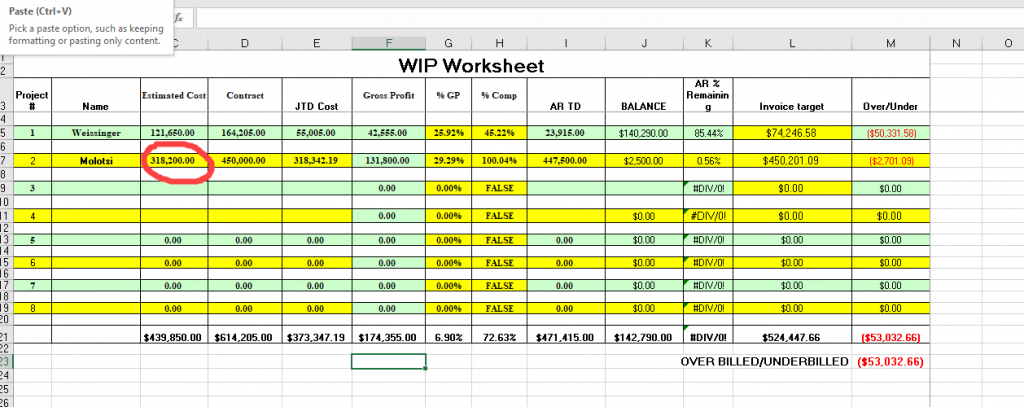

Have your transactions entered up to date with all accounts reconciled through the adjustment date - I recommend using a spreadsheet like this to help you calculate the to date actual costs vs. estimated and actual revenue vs. estimated

For each month, here’s what you are going to do:

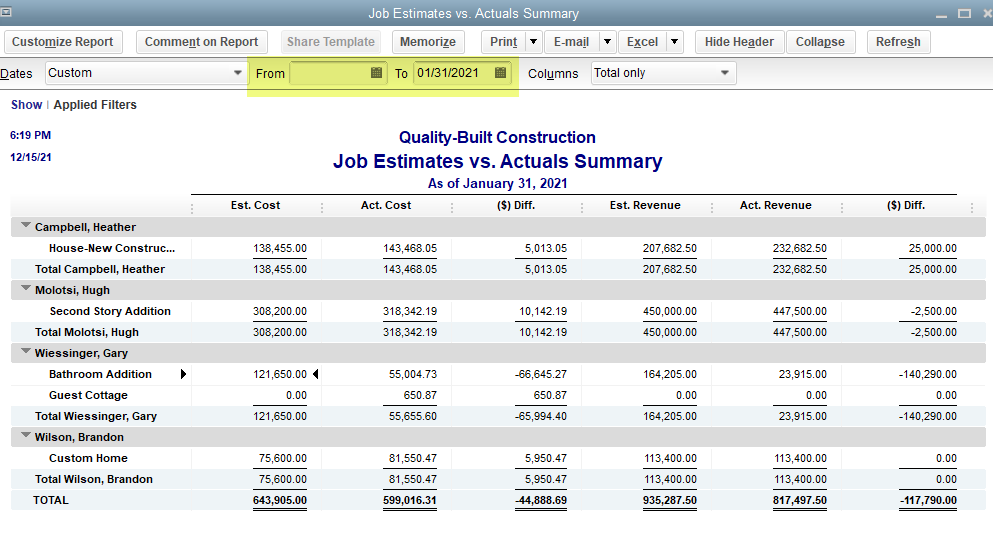

- Run an Estimates vs. Actuals by Job Summary report in QuickBooks, with NO beginning date and the end date being that of the period you are adjusting (do not filter just for that period on the beginning date!):

For any jobs that are not complete through that period, calculate the % of completion of costs and the % of completion of revenue for that period. I like using this spreadsheet:

For any jobs that are not complete through that period, calculate the % of completion of costs and the % of completion of revenue for that period. I like using this spreadsheet:

Notice a couple of things:

- I did not include all of the jobs from the Estimates vs. Actuals summary, because I am not going to include any jobs that have been completed during this period. If the costs and revenue are at 100%, I’m going to presume the job was completed during or before this period and no % of completion is needed on a completed job. Note: Estimates that have been made inactive will not show on Estimates vs. Actuals report.

- The Molotsi job costs EXCEED the estimated costs. This system does not in itself account for cost overages and it’s really skewing my % of completion of costs vs. revenue. In this scenario, I’m going to analyze this job more closely and recognize a known cost overrun of $10k by increasing my estimated cost by $10k, making the estimated costs $318,200 instead of the original $308,200.

- NOW: This nifty spreadsheet is calculating, through 1/31, the amount over or under billed for that period

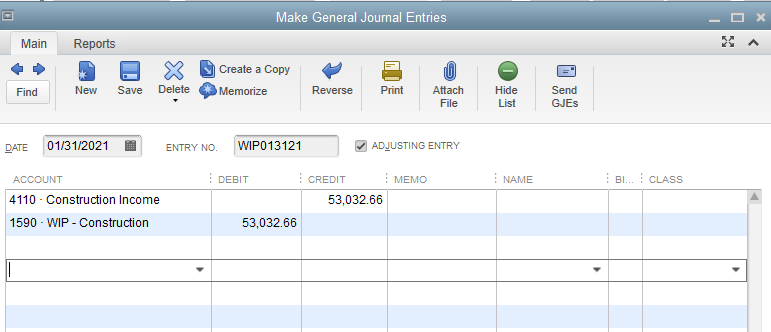

Now, I am simply going to do a journal entry to INCREASE my Income by that amount (CREDIT) and INCREASE my WIP Asset account by the same amount (DEBIT) – it’s an asset to me because I’ve done this work and the money is coming to me (if I were over billed, I would do the opposite – DEBIT Income and CREDIT a WIP LIABILITY account):

Now, I am simply going to do a journal entry to INCREASE my Income by that amount (CREDIT) and INCREASE my WIP Asset account by the same amount (DEBIT) – it’s an asset to me because I’ve done this work and the money is coming to me (if I were over billed, I would do the opposite – DEBIT Income and CREDIT a WIP LIABILITY account):

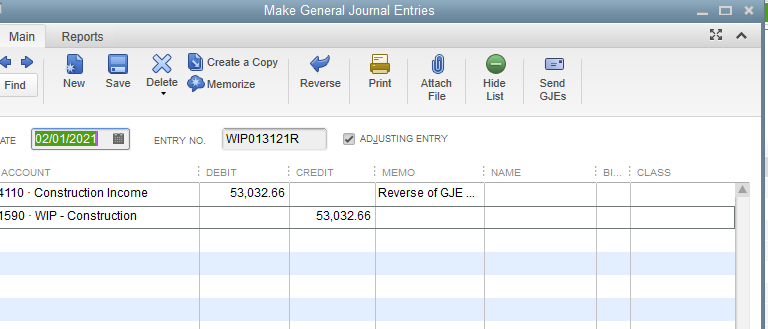

Then I’m going to REVERSE IT, notice the reverse date is the first day of the next month

Then I’m going to REVERSE IT, notice the reverse date is the first day of the next month

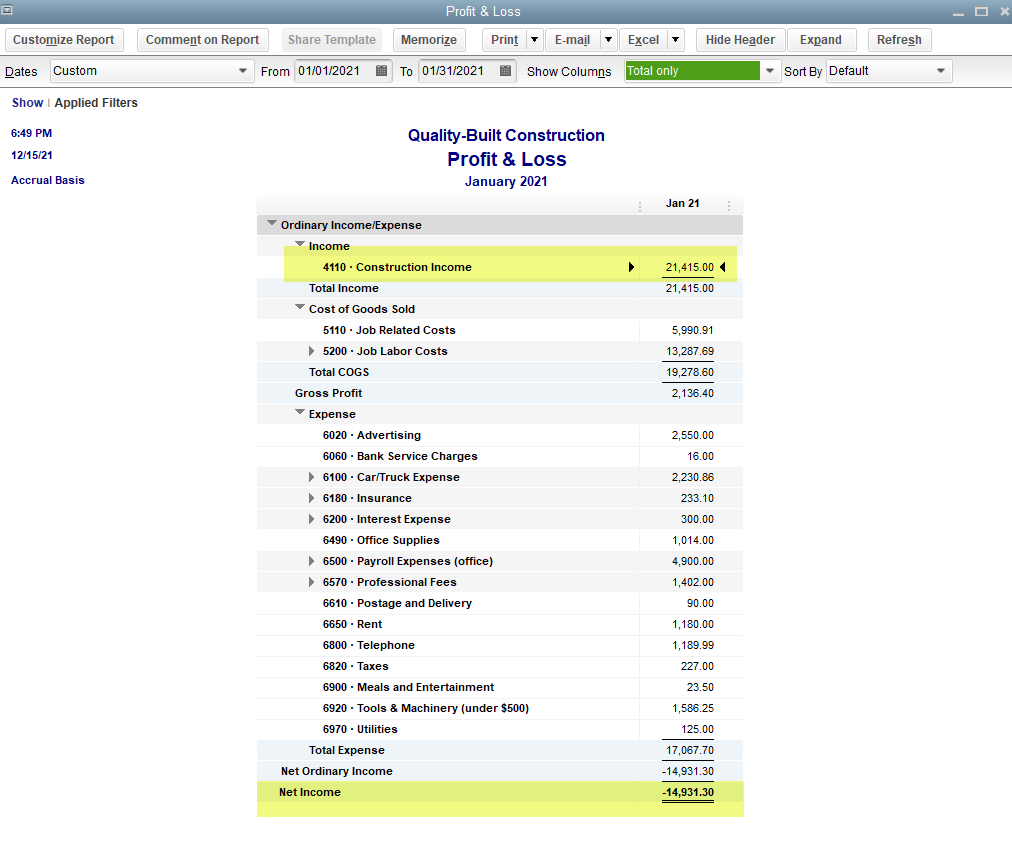

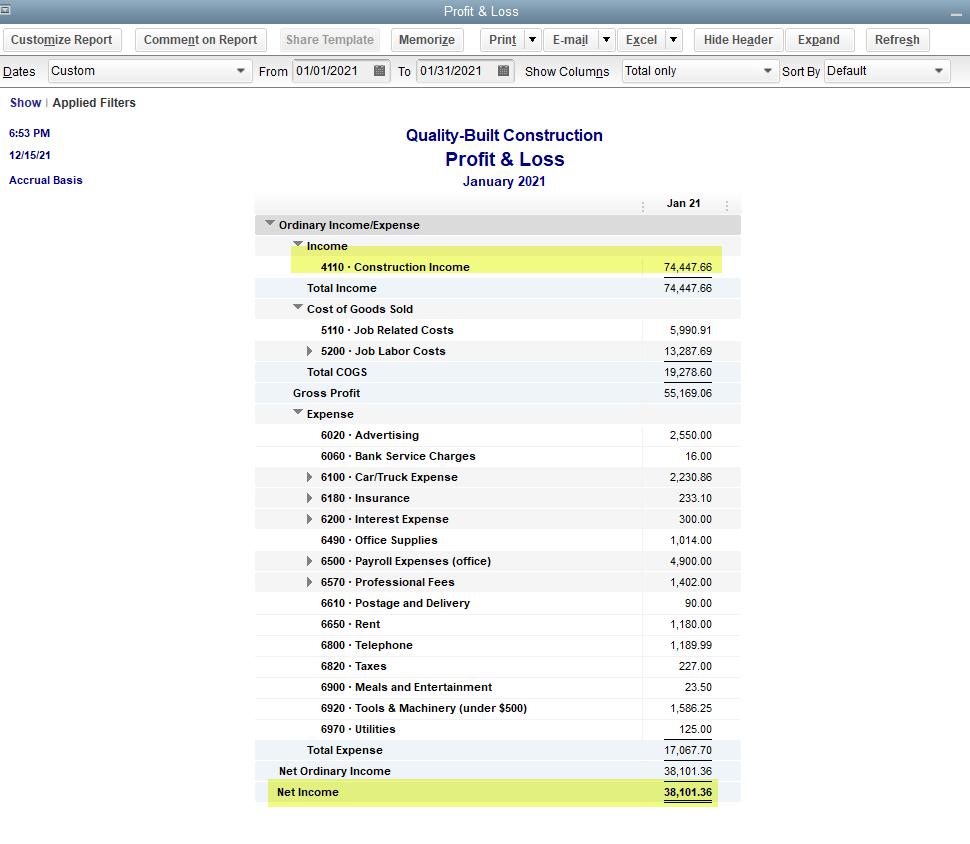

This is what the Profit and Loss looked like BEFORE the adjustment:

This is what the Profit and Loss looked like BEFORE the adjustment:

I know what you are thinking: “You lost me at REVERSE the entry” (well, maybe I lost you a bit before, but I swear it’s not as complicated as it seems). Here’s why we reverse the entry – because we’re going to do the whole thing again next month. That reversal brings us back to square one. We need to be at square one, because we will likely invoice for this under-billing in February and we know the costs have already happened in January or some point before that. It’s also why it’s important to do this EVERY MONTH. Otherwise, February could be terribly skewed.

I know what you are thinking: “You lost me at REVERSE the entry” (well, maybe I lost you a bit before, but I swear it’s not as complicated as it seems). Here’s why we reverse the entry – because we’re going to do the whole thing again next month. That reversal brings us back to square one. We need to be at square one, because we will likely invoice for this under-billing in February and we know the costs have already happened in January or some point before that. It’s also why it’s important to do this EVERY MONTH. Otherwise, February could be terribly skewed.

If you are still with me, Bravo! I KNOW this is a lot to take in, particularly if your accounting experience is limited. It is, however, what you must do if you ever want to see a Profit and Loss report that truly represents what is happening in your business. It’s really the only way to know whether or not you are actually profitable!

And, here’s the thing: If this is a little over your head, that’s ok. You can hire someone to do this for you (MEEE!), or to teach you how to do this (MEEE!). This is the type of service I offer to my Outsourced CFO customers and I’ve got videos on this in my Job Costing Intensive Program. You aren’t necessarily going to completely “get” all of this stuff the first, second, or even 10th time and that’s OK. This is why I often work with clients over time.

The Profit and Loss Report, as important as it is, is only a piece of the puzzle. I highly encourage you to read my other articles in this series: Why Focusing Only On Job Cost Reports Is A Big Mistake, Assigning Overhead to Job Cost Reports – Don’t Do it!, and Margin vs. Mark up for Contractors.

Are you working for a better future for yourself and your family or just working? If you’re like many (most?) contractors, when it comes to the financial stuff, you find yourself making decisions from more of an intuitive position than actual numbers and reports. You may feel uneasy or even deeply concerned about this, but try as you might, nobody can seem to provide you with information that makes sense. While maybe you will never relate to your financial reports at the same level as an accountant, you absolutely can and should be able to get sound reports that you can use to make sound decisions. You absolutely can learn how to analyze and understand your financial reports. Most people reach out to their bookkeeper or their CPA and find that this stuff is over the head of their bookkeeper and the CPA is just too tax focused and/or not interested in diving into this with you, and it can feel discouraging.

That’s where I come in! This is my THING, and while I’m not a CPA, I can help you not only get your books in order, I can help you actually put the information in your accounting system TO WORK FOR YOU with my one on one Coaching and CFO services. Chances are, you’re intuition is pretty good, but what might you be missing and what would it feel like to know for sure? I can teach you how to understand the story your financial statements are telling you and give you the solid data in order to make better and more profitable decisions!

Questions? I can help! Get one on one training and support from Penny Lane, like my Facebook page for the latest Tips and Tricks, , find me on LinkedIn, follow me on Twitter, and Subscribe to my Youtube channel