QuickBooks Online vs. QuickBooks Desktop — which is best for contractors?

I have a confession to make: I love them both!

I’m passionate about helping bookkeepers, contractors — and those who find themselves acting as bookkeepers — get the reports and numbers they need out of QuickBooks so they can make smart decisions.

Keep on reading to get up to speed on what job costing in QuickBooks Desktop vs QuickBooks Online really looks like.

I’ll highlight the most important differences so you’ll feel empowered when recommending either QuickBooks Online or QuickBooks Desktop to your clients — or when you’re making an educated decision for yourself as a business owner.

The main differences we’ll be exploring are:

- Projects Dashboard

- QuickBooks estimates vs. actual reports

- Job costing of labor

- Cloud-based access

- Third-party program use and integration

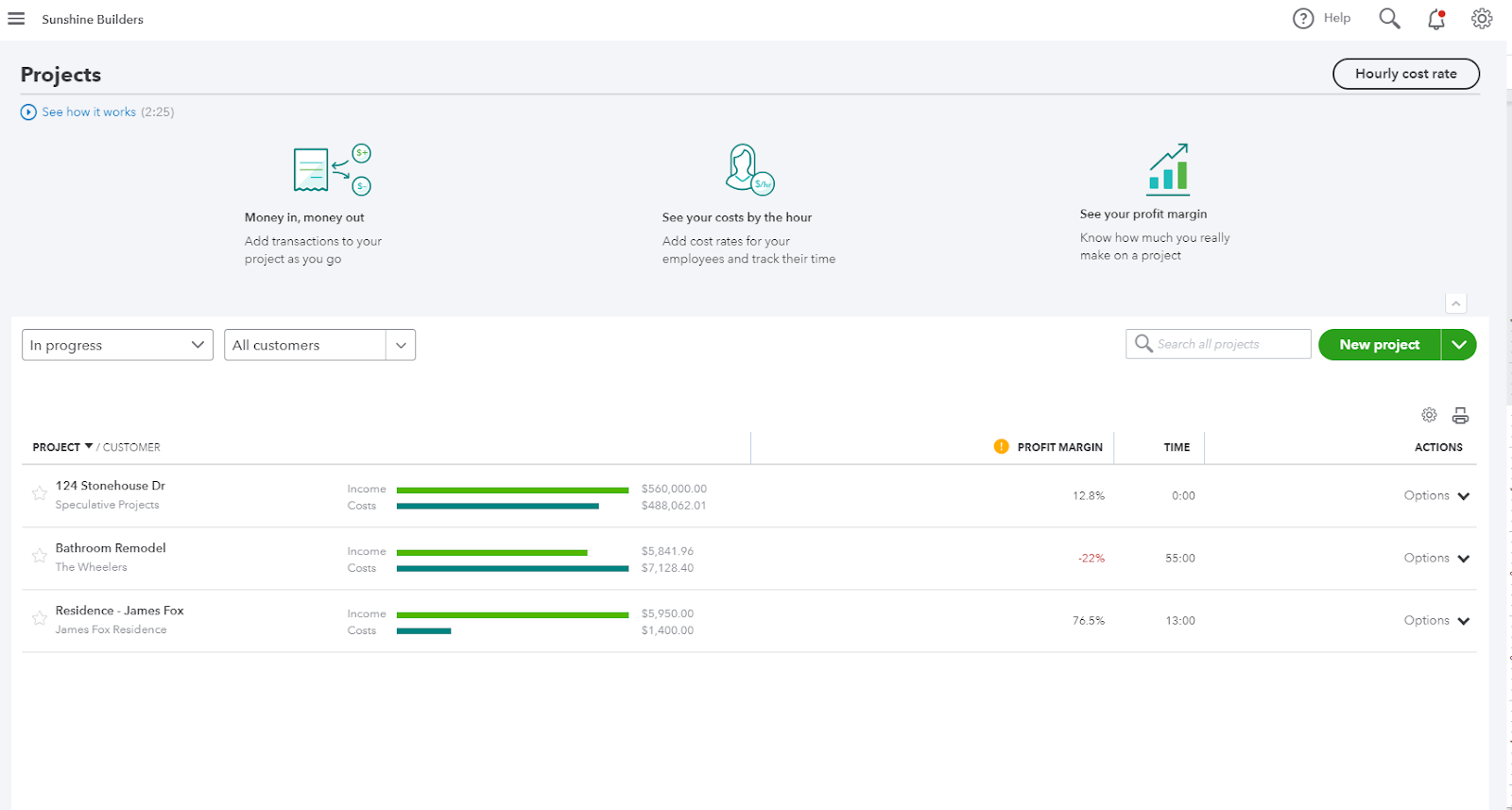

Projects Dashboard

QuickBooks Online has a really cool dashboard feature for Projects that QuickBooks Desktop just doesn’t have.

I won’t go into too much detail here, but there’s a dashboard of all Projects. When you click on one, you open up a dashboard with (almost) everything pertaining to the Project in one spot.

I love that it’s a one stop shop with a list of all Projects filtered by status.

Take a look here:

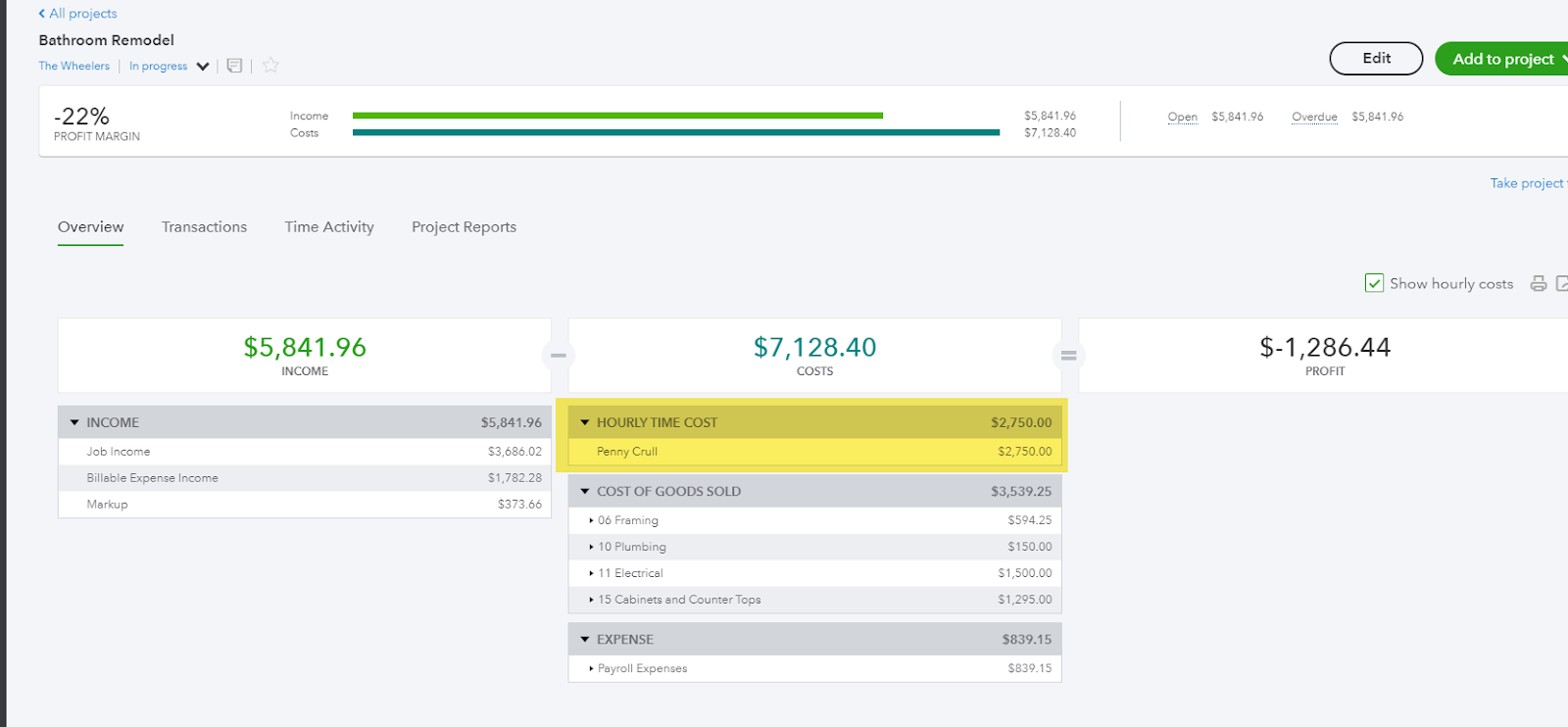

With one click to access the individual project dashboard. Inside the Project dashboard, you’ll find some lovely graphics and reports on the Project’s revenue, costs and profitability.

On the tabs you’ll find almost all of the reports and transactions associated with the Project, including Time assigned to the Project, transactions like invoices, estimates and costs, as well as several Project reports.

QuickBooks Estimates vs. Actual Reports

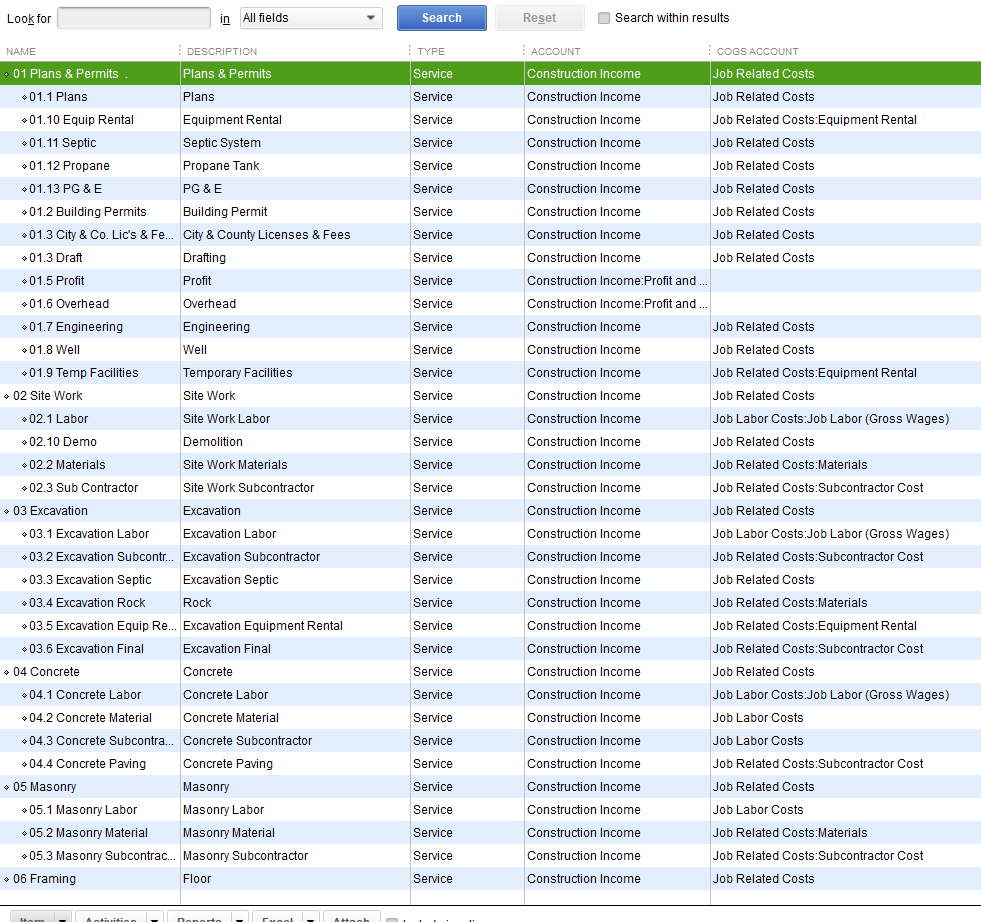

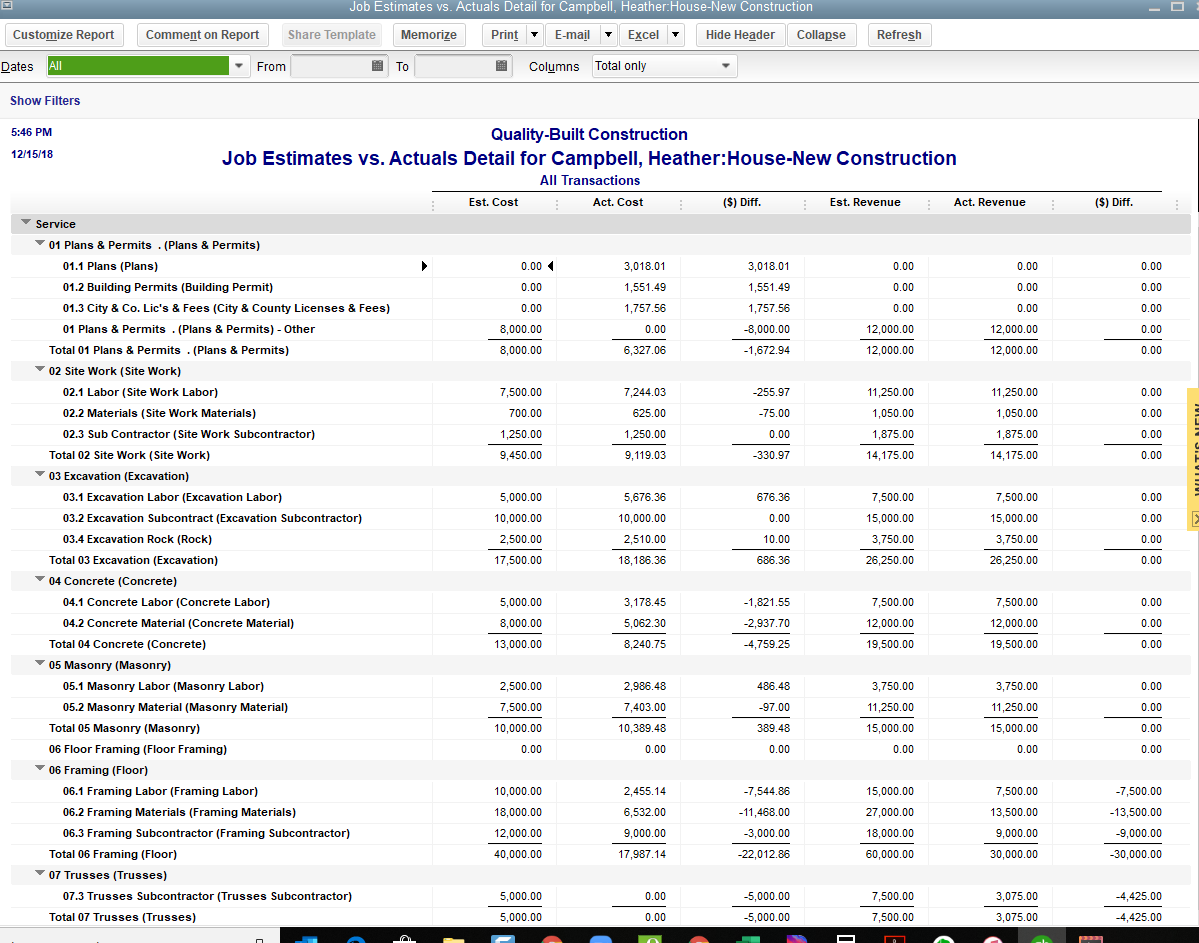

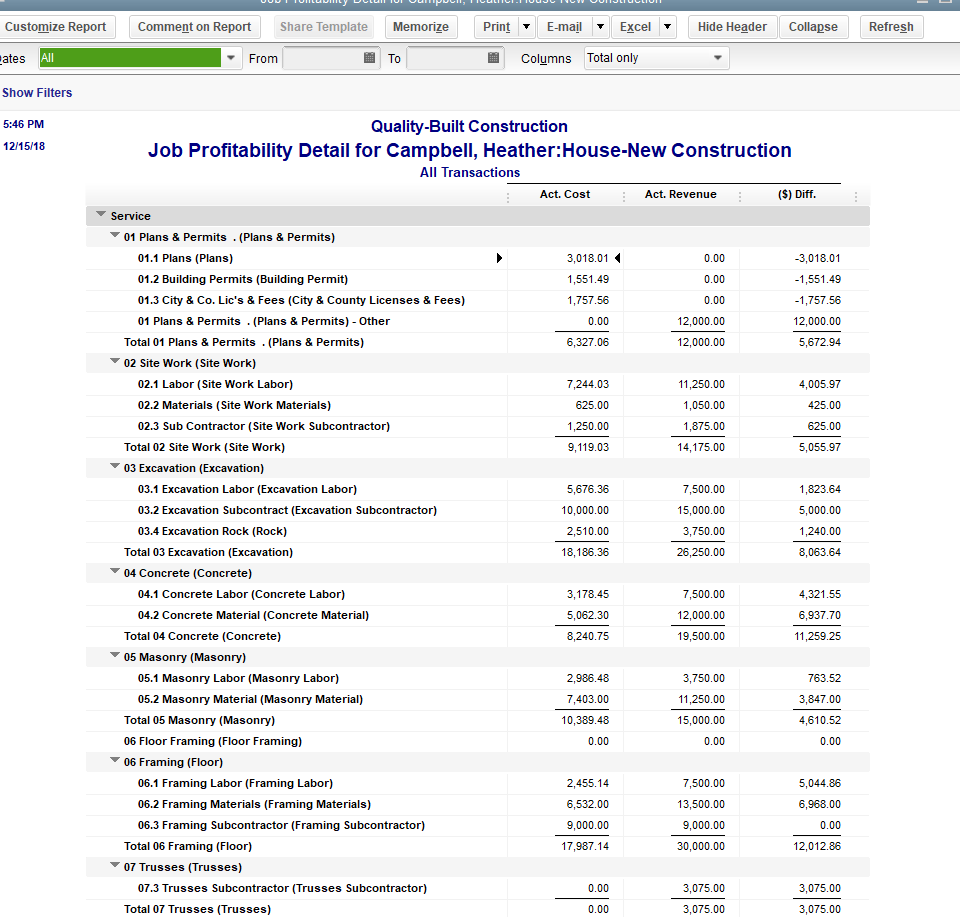

In QuickBooks Desktop, the key job costing reports — the Job Estimates vs. Actuals and the Job Profitability Detail report — are item-based.

This allows you to set up your cost codes as Items and keep your chart of accounts very simple. The items are used to record all job-related costs on all invoices, purchase orders, and estimates.

Your cost of goods sold accounts look something like this:

Meanwhile, your item list will look something like this (except usually, it will be a lot longer):

Your job cost reports look something like this:

In QuickBooks Online, the items — called Products and Services — play a much smaller role. In most cases, there’s no need to enter the costs to the items, because there aren’t any item-based job cost reports.

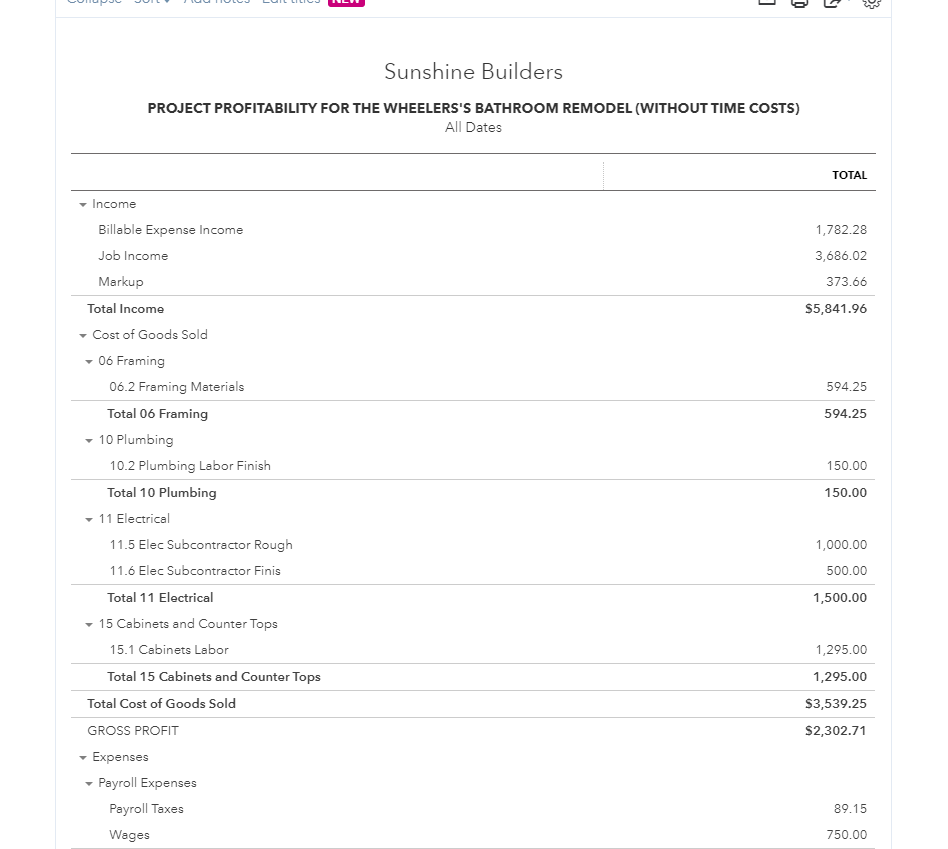

In QuickBooks Online, the Job Profitability Report and the Job Budgets vs Actual (which is as close as we can get to the Estimates vs. Actual available in QuickBooks Desktop) are based on the cost of goods sold accounts.

The items are only used for estimates and invoicing. You can use the items to record costs, but you can’t choose them when entering transactions from the bank feeds. This then results in a lot of data entry, negating one of the best features of QuickBooks Online.

In QuickBooks Online, your cost of goods sold accounts will represent your cost codes — meaning you could have dozens or even hundreds of COGS accounts:

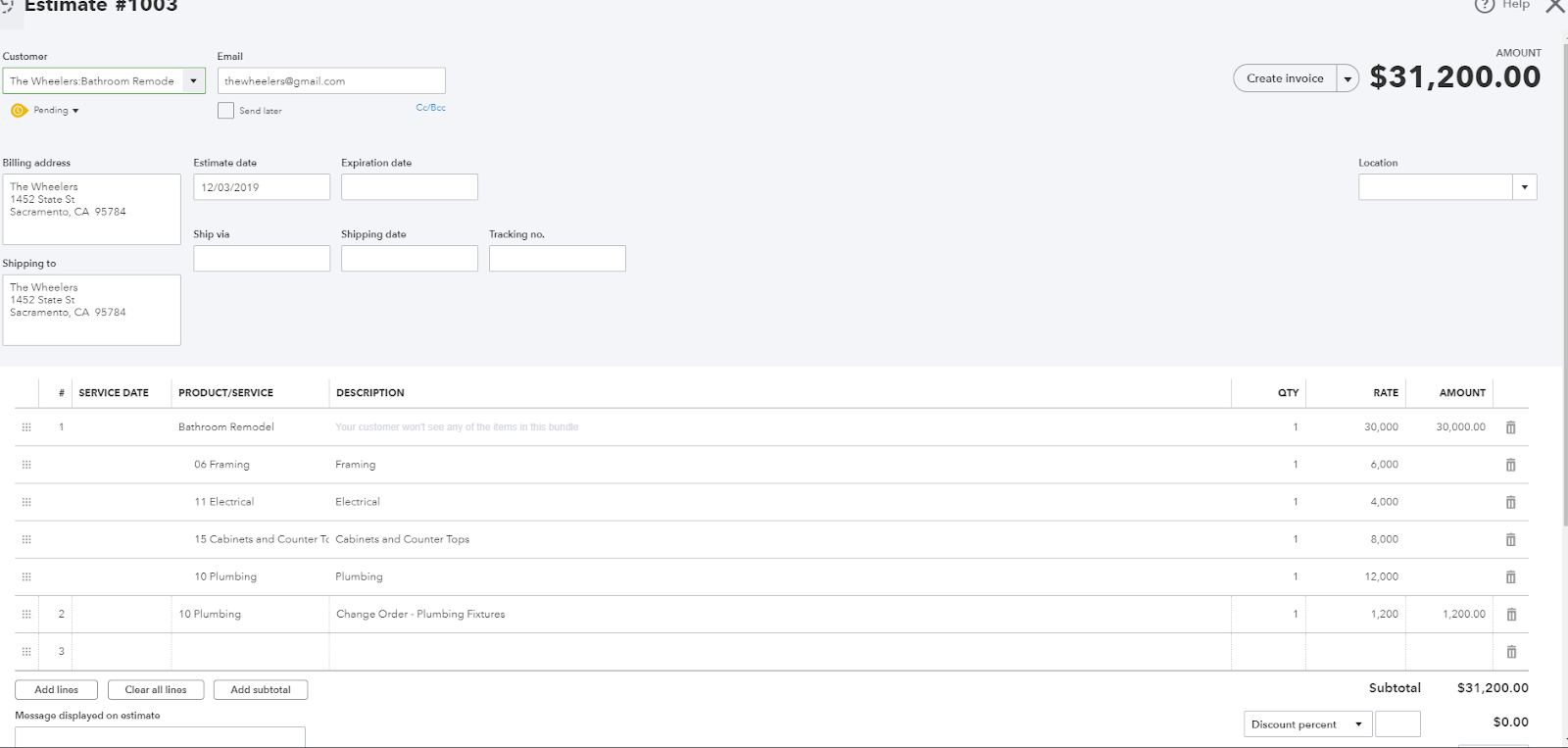

Depending on how you invoice your clients, your Item list may also represent your cost codes. If you do lump sum invoicing, it may be just an item or two.

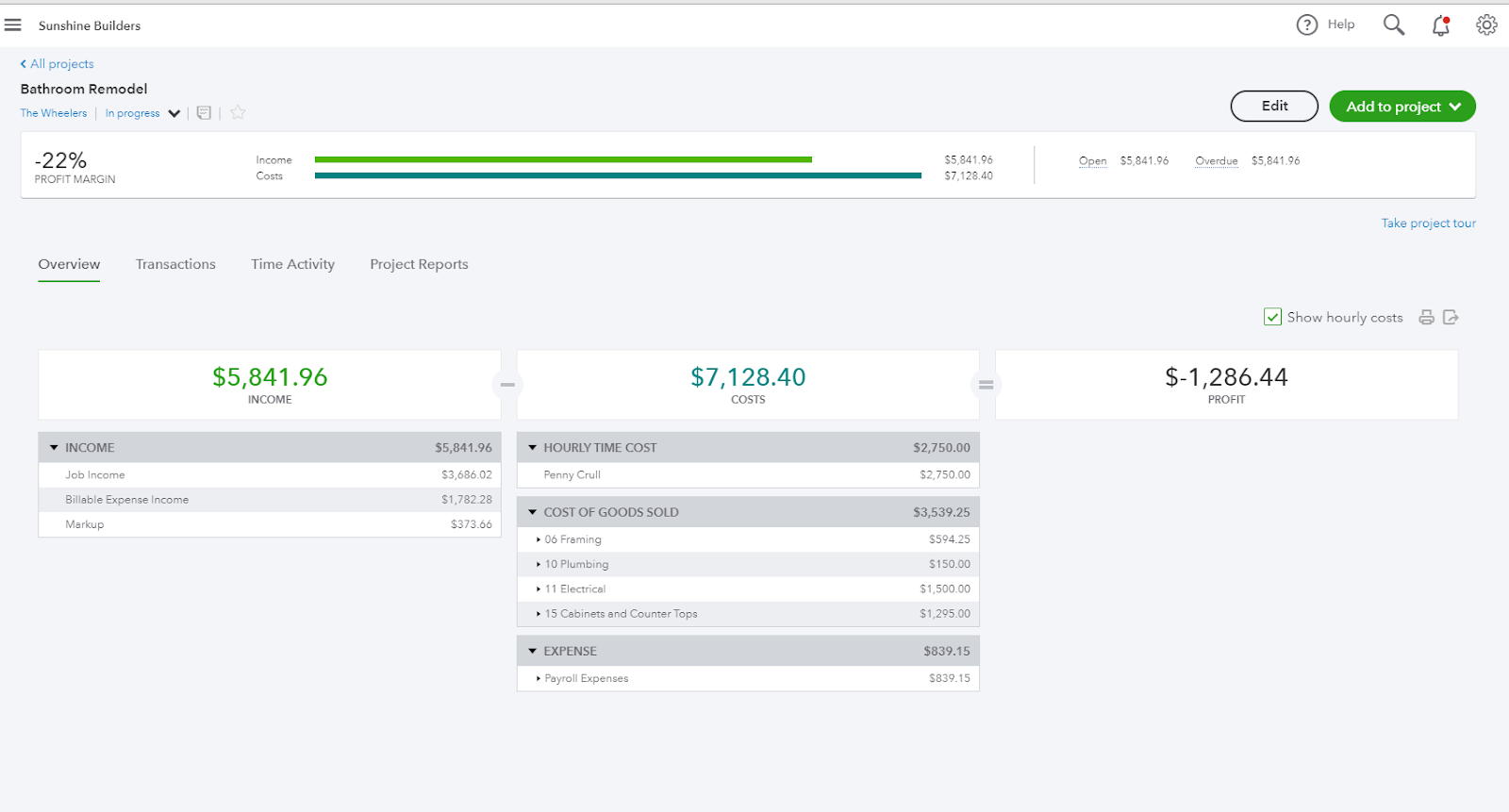

On the other hand, your Job Cost reports are a bit different. You can access your Job Profitability report from right inside the Project dashboard — as you’ll see, it’s essentially a Profit and Loss for the job:

To create Progress Invoices, you’ll want to create an Estimate:

To create Estimates vs. Actual reports, though, you’ll need to also create a Budget with the cost-code level detail of the estimated costs. The Budgets vs. Actual report is NOT available from the Projects dashboard and will require some customizing.

It might sound like kind of a pain, but this works just fine for most contractors.

There are a few very important reports that, unfortunately, just aren’t available in QuickBooks Online.

If you are familiar with them in QuickBooks Desktop and you do over/under billing Work In Progress adjustments, you might really miss these, to name a few:

- Estimates vs. actuals summary

- Job WIP report

- Unpaid bills by job

In Summary, job costing in QuickBooks Desktop is item-based. In addition to what I’ve described here, it features much more extensive reporting — not to mention seamless reporting capabilities for Job Costing.

QuickBooks Online, however, has a very impressive Projects Dashboard. You can avoid a lot of data entry by using the bank feeds to import transactions if you aren’t using the items to record costs.

Job Costing of Labor

For me personally, the biggest issue is the job costing of labor. When I say labor, I mean employees you pay on payroll for job or project related labor.

I’m not going to go through all of the details of setting up and using these functions when you’re still in the process of assessing which version is better for your needs — but I will go into enough detail that you’ll understand exactly what’s involved.

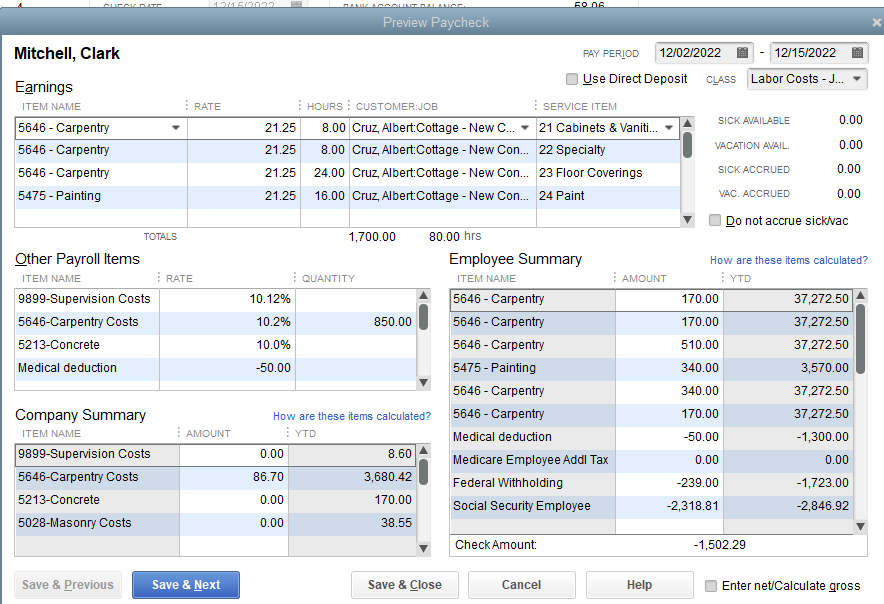

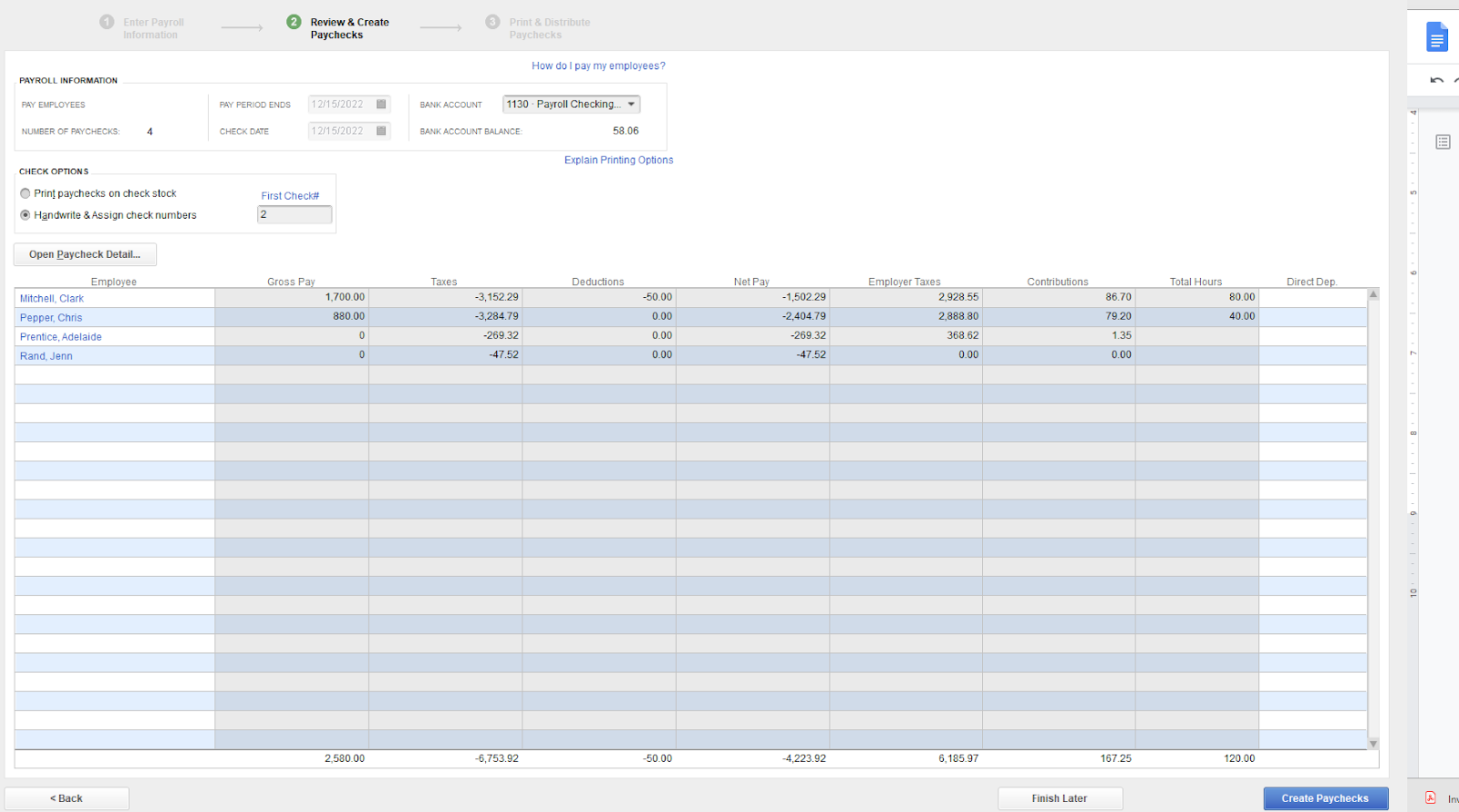

The payroll system in QuickBooks Desktop does an amazing job of allocating your labor costs. This includes payroll taxes, benefits and worker’s comp, and jobs.

QuickBooks Desktop pulls this off pretty efficiently, too. Once you’ve got it set up and entered the time into the system, your labor costs are allocated when you run payroll. That’s it! Getting the time in is probably what takes the most work. If you use TSheets, this process is even more of a breeze.

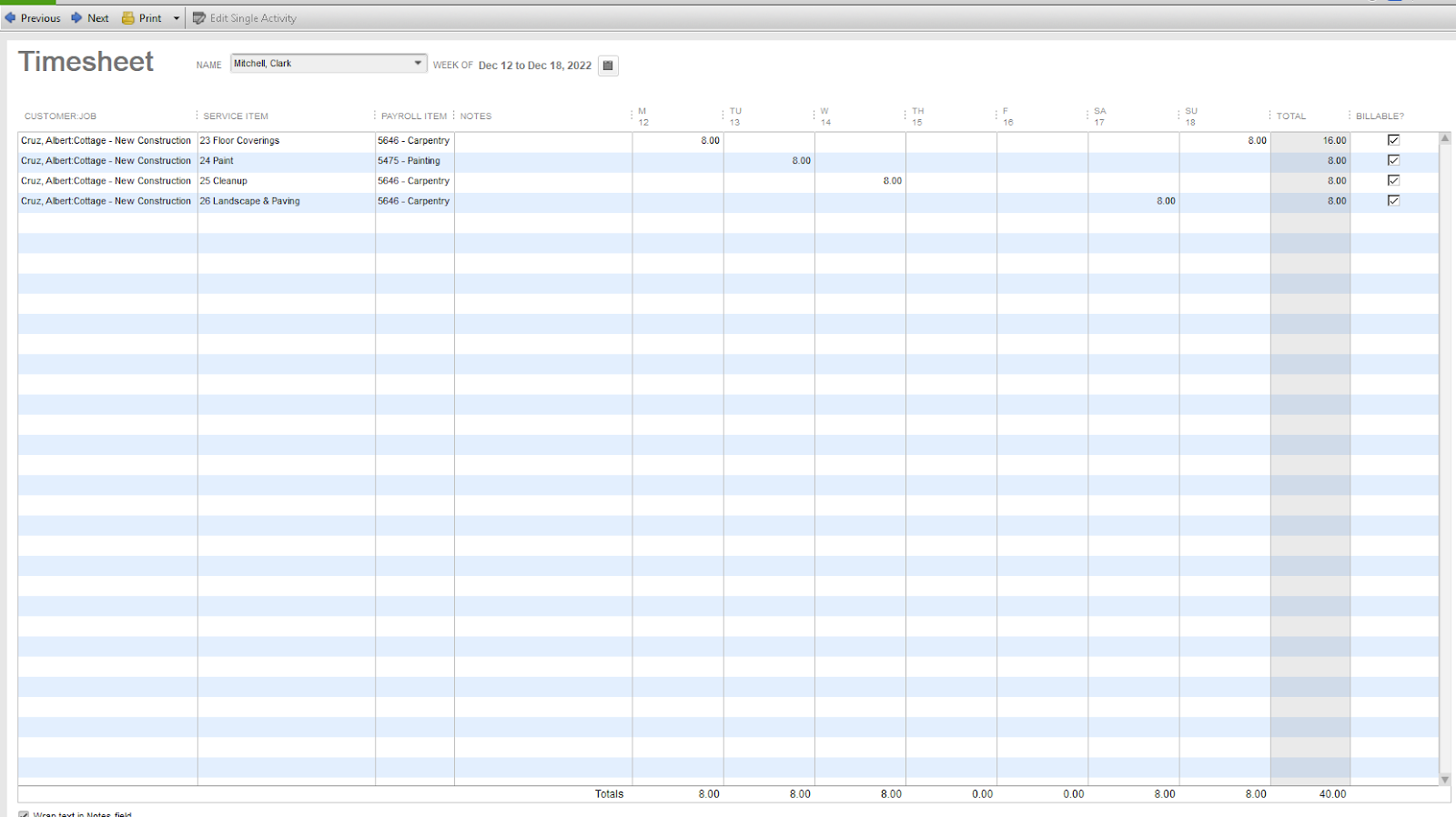

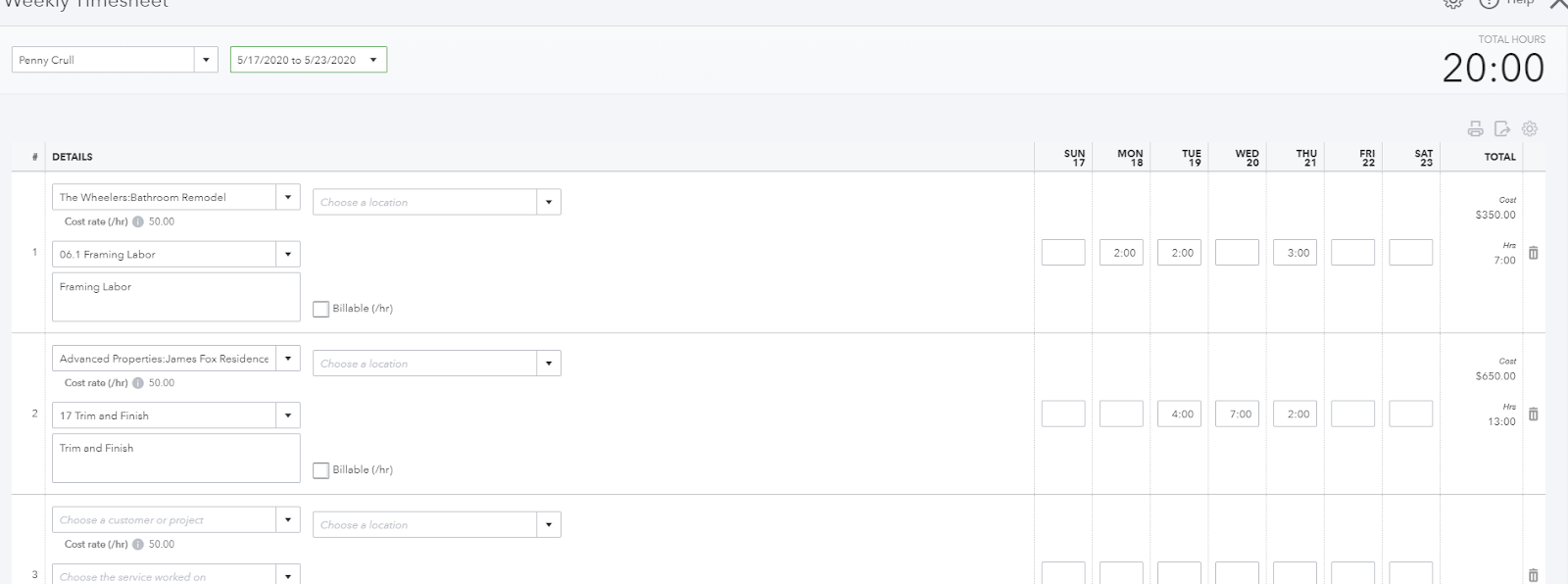

I’m leaving out a lot of the finer details to keep things simple. At this point, though, you’ve basically got the time in, allocated to the job and service item. You’ll see something like this:

From there, you simply run the payroll (the time pulls into the paycheck automagically, as I love to say). The labor costs, including burden, will then post to the job.

It’s pretty much the same process if you use an outside payroll service — with just a couple of tweaks. (I made a video to show you exactly how all of this works on my website under Tips and Tricks.)

With QuickBooks Online, you’ll face a different situation altogether. While the QuickBooks Online process is similar to QuickBooks Desktop, it’s different in these key ways:

- Gross payroll and payroll tax are the only costs captured. No other burden like work comp, which is kind of a big deal — and quite a pain to allocate separately.

- The payroll costs are captured in ONE account only. You won’t be able to break down the payroll costs into different cost codes for estimates vs. actual reporting. You’ll understand this a little better in a few minutes after I explain it further down below. Stay tuned!

- You MUST have the time entered on the time sheets prior to creating payroll. You can’t open the paycheck to review or edit the job costing — it’s just happening, so you’ll have to just presume it’s happening correctly.

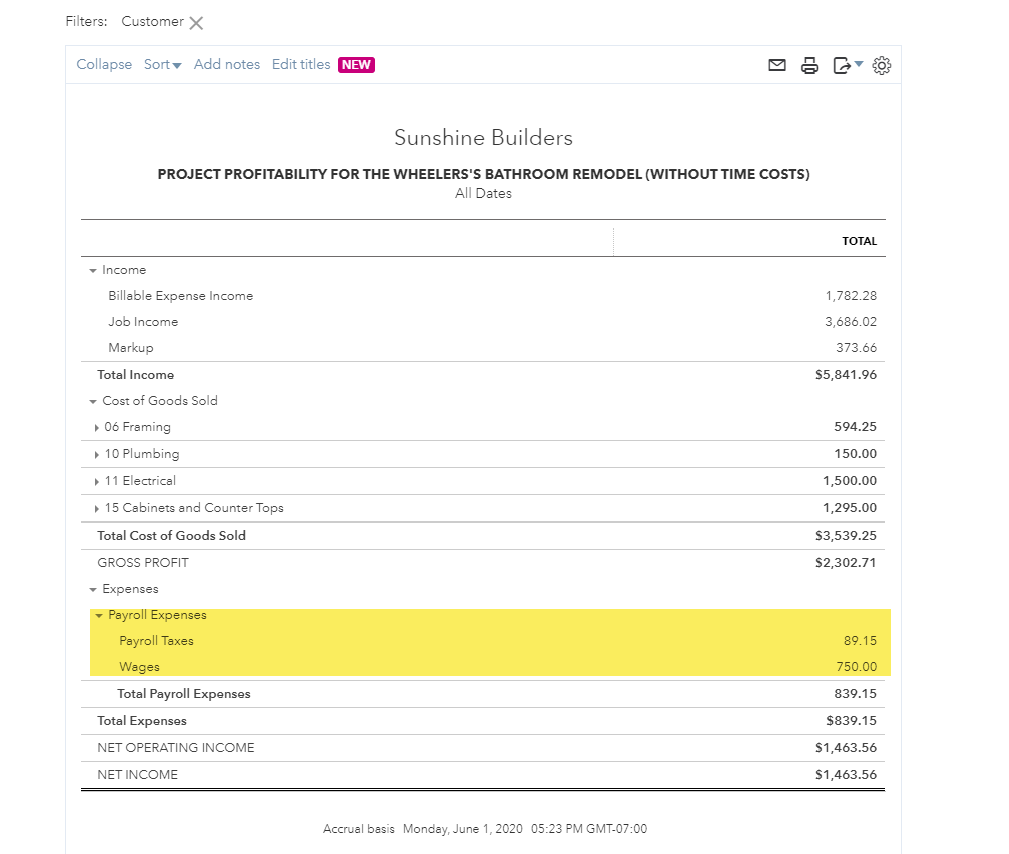

This is what it looks like on profitability and estimates vs. actuals reports:

Here’s a timesheet example — even though the time is there by service item, it WILL NOT SHOW UP on any reports to the service item or on the profitability or Estimates vs. Actual reports. Time can also come in from TSheets:

This is a serious limitation if you need to see your labor costs broken down by cost code. However, if you’re a specialty contractor and you just need to see your total labor costs in one account/cost code, it’s a great option. You can always just build the burden into your mark-up.

QuickBooks Online Job Costing Labor Option 2 – The Time Cost Method

Can I be honest with you? I hate this one!

This method leverages a burdened rate. It’s super easy to use, which I love — but the labor costs don’t show up on any reports. You’ll see them in one place only, and that’s the Project Dashboard.

This may work just fine for some, but I have a hard time with it not showing up on the Job Estimates vs. Actual or Job Profitability reports.

QuickBooks Online Job Costing Labor Option 3 – The TSheets, Pivot Table, Journal Entry Method

Okay. This might sound complicated at first, and it CAN be problematic, but it’s the best method for getting fully burdened, cost-code-level job-costing in QuickBooks Online.

This is best used with an OUTSIDE payroll service. If you use QuickBooks Online payroll, you won’t be able to import the time, or you’ll have duplicated labor costs.

I’m going to skip a lot of details here to keep things simple, but if you need more clarity right now, I have a video on it in my QuickBooks Online Projects training.

Here’s the gist:

- Run a report in TSheets

- Export the report to excel

- Create a pivot table

- Make a journal entry into QBO.

Although it sounds like a lot of steps, it’s not very complicated and it may not take much time at all.

The job costing of labor requires far more work in QuickBooks Online than in QuickBooks Desktop, if you need it broken down by cost code. However, it’s not necessarily a deal breaker.

Regardless of how many employees you have, if you’re only working on a couple of different jobs/different cost codes each pay period, it’s really not overly complicated or time consuming.

If you’re working on a lot of different jobs and/or a lot of different cost codes each period, this could get to be a very long journal entry. But it works!

I have more detailed videos on all of this in my QuickBooks Online Projects training.

Cloud-Based Access

QuickBooks Online is natively web based. QuickBooks Online Plus comes with five full access users plus two accountant users, QuickBooks Online Advanced includes 25 users and three accountant users. QuickBooks Online Essentials doesn’t have Projects or many of the features most contractors need.

If you have employees whose time needs job costed, I recommend a subscription to TSheets, which is also web based. You can use a spreadsheet in some cases — but in most cases, TSheets is going to be the most efficient. (Pro tip: QuickBooks Online Advanced comes with TSheets at no extra charge!)

QuickBooks Desktop can also be accessed remotely, either with Qbox, hosting, or a teamviewer type program.

Qbox is the most economical — currently $12/mo per folder (a folder being where the data file lives in the cloud that can be shared between different users/computers for the one price).

This option works well for accessing your data remotely from different locations or for bookkeepers sharing access with clients — one at a time. This does not work well for most cases of multi-user, simultaneous access. For that, I recommend hosting.

Qbox is similar to Dropbox but for Quickbooks data files (NEVER store your data file on Dropbox or Google Drive), and you’re always working locally. The updated data file syncs to your computer and back to the cloud — so fast, you can hardly track it — so there are never any delays while working.

Hosting. When your QuickBooks data is hosted, you access the data via a remote desktop connection. You can set this up with your own server using the Windows remote desktop software.

For security and IT cost reasons, I recommend you have it hosted by a third party, such as Intuit’s official provider and the one I prefer, Right Networks. You access QuickBooks anywhere, anytime, as long as you have an internet connection. You can have multiple simultaneous users, and the cost is between $44-$60/month per user (users can be shared, just not simultaneously).

Third-Party Program Use and Integration

QuickBooks Online. If you have one of the more robust job costing scenarios, a large number of projects, cost-code level labor costing — or are otherwise running up against the limitations of QuickBooks Online, but still want to use it — you can add a third-party software solution.

A third-party software solution can resolve the job costing limitations that exist in QuickBooks Online, as well as add lots of other awesome project management features — like take-off estimating, scheduling, client and vendor communications, AIA invoicing, and more.

It sounds great, right? And it really can be. BUT there are a couple things you need to know about this option:

- Currently (this may have changed by the time you’re reading this), the only third-party app I’m aware of that integrates with the Projects feature in QuickBooks Online is TSheets.

This just means that in most cases, the third-party software will be handling all of the job costing, and QuickBooks Online will just handle the accounting. So, you won’t be using the Projects feature in QuickBooks Online at all.

- In most cases, all job-related costs will need to be entered directly into the third-party system and “sent over” to QuickBooks Online.

This usually means a lot more data entry than using QuickBooks Online on its own, as you won’t be using the bank feeds to import these transactions. In some cases, like with Knowify, you can enter the transactions directly in QuickBooks Online and send them to the job costing/project management software.

However, you still won’t be able to use the bank feeds, because you will need to post them to the items in order for them to show up correctly in the job costing software. This is how most third-party systems talk to QuickBooks Online.

I don’t consider this a deal breaker, because you often have a lot of data entry with QuickBooks Desktop. I just think it’s important to know because it’s sometimes one of the main reasons people want to use QuickBooks Online.

Some of the more popular third-party solutions for QuickBooks Online are:

- Jobber or ISM Corrigo for service-based businesses

- Knowify, BuilderTrend or CoConstruct for general contractors — most of these do AIA invoicing, contracts, and scheduling

QuickBooks Desktop. It does a great job of job costing on its own, but you can also integrate third-party project management software with it as well for project management features.

With this scenario, you usually have good job costing in both the third-party software AND QuickBooks, which is nice.

I also like that, with all of these that I’m aware of, you enter all the transactions in QuickBooks and the data imports into the project management software.

The bookkeeper doesn’t usually have to get into the third-party software — and the contractor doesn’t have to get into QuickBooks.

Popular third-party solutions for QuickBooks Desktop Project Management are:

- Corrigo or Service Titan for service-based businesses

- UDA Construction Suite, Knowify, BuilderTrend or CoConstruct for general contractors — most of these do AIA invoicing, contracts, and scheduling

It is good to know, though, that, for the most part, QuickBooks Online integrates much more seamlessly with third-party software than QuickBooks Desktop due to the nature of cloud-based vs. locally based integration.

In conclusion: QuickBooks Online vs. QuickBooks Desktop — which is best for you?

By now you’ve probably made up your mind about whether QuickBooks Online or QuickBooks Desktop is right for you. Let’s sum everything up for quick at-a-glance clarity.

QuickBooks Online is best for:

- Specialty contractors and speculative builders who don’t need cost code level labor job costing, or

- General contractors who don’t have a large number of jobs in progress or cost codes for labor job costing in any particular week, and are willing to use TSheets

- Any contractor who is comfortable with technology and wants to use a third-party project management app

QuickBooks Online can accommodate any level of job costing with a third-party add-on. Just keep in mind that the integration is a thing that needs to be managed — and you’ll lose the convenience of using the bank feeds for entering job-related costs. These have to be manually entered into the third-party system or to items.

Currently, TSheets is the only third-party software that works with Projects. You’ll need to make sure your job costing can be done in that third-party app only, it won’t be done in QuickBooks Online.

QuickBooks Desktop is best for:

- Those who are primarily looking for solid and detailed job costing

- Those with prevailing wage payroll, a lot of different jobs going, and multiple cost codes for labor costing — who don’t want to deal with integrating a third-party app or entering their transactions in a third-party app

I hope you’ve found this information helpful as you make your decision about which option is best for you!

You can find my on-demand QuickBooks training videos for both QuickBooks Desktop and QuickBooks Online.

Still unsure if QuickBooks Online or QuickBooks Desktop is best for you?

If you are still not sure which is the best choice for you, watch this quick 30-minute video that walks you through the key differences.

This video shows you exactly:

- Why QuickBooks Desktop is definitely the winner for functionality — if you need the functionality it offers, that is

- The QuickBooks Online dashboard feature for projects that QuickBooks Desktop just doesn’t have

- How they each navigate job cost reports

- How to avoid lots of data entry by using the bank feeds to import transactions

- Why whether or not you use the payroll feature could be the deciding factor when you make your choice

- How the time-cost method leverages a burden rate — any why the labor costs don’t show up on any reports

- And more insights into which is the best choice for you in terms of ease, functions, cost, etc…

With this video, you’ll feel fully equipped to make an informed decision for your own business — or to recommend the right QuickBooks product for your clients.

About Me

I’m Penny Lane, I’ve been a Certified QuickBooks Pro-Advisor since 2006, and I’ve been in the bookkeeping business for over a decade.

I’ve spent literally thousands of hours doing hands-on bookkeeping for all types of businesses, mostly contractors. For the past few years, I’ve been teaching contractors and their bookkeepers how to put QuickBooks to work for their business.

If you’re struggling with QuickBooks for Contractors, please know it’s not you! It’s not plug and play. No matter what type of contracting business you have, I can show you how to put QuickBooks to work for your business.

You CAN get the information you need to make brilliant decisions and more money from QuickBooks. And I can show you exactly how.

I wasn’t always an “expert.” In fact I spent many, many years learning — sometimes the long, hard way. I made a lot of mistakes along the way, and I’ve come up with a lot of solutions.

My passion is helping hard-working contractors succeed financially in an often-challenging industry. I love knowing I’ve made a difference — and I would love to help you, too.

“Penny is the easiest and most knowledgeable QB consultant I have worked with. She is very tech savvy and is able to log onto your system and work directly with your personnel to accomplish whatever is necessary. Her knowledge of accounting and particularly construction accounting is very strong. It is invaluable to me to be able to work through problems in real time one-on-one with her.

My books are correct, they look very professional, I have already filed tax returns, and could not have done it without her. Her fees are well justified (to me) so I can focus on what I know best — my business, not bookkeeping issues.”

— Daniel Sereni

Let’s stay connected:

- For tips-and-tricks articles and videos, a chart of accounts template and list templates, or to schedule one-on-one support sessions with me, head over to my website

- Join my Facebook group for Construction Accountants and Bookkeepers

- And subscribe to my YouTube Channel

- Email me at [email protected] — I always love to hear from you